Zum Rails Onboarding Application

Zum can offer you such great transaction rates because it underwrites the business and provides you with your own merchant account. Because that comes with some risk, Zum will also ask for detailed business information and estimates of the volume of funds you plan to release through their platform.

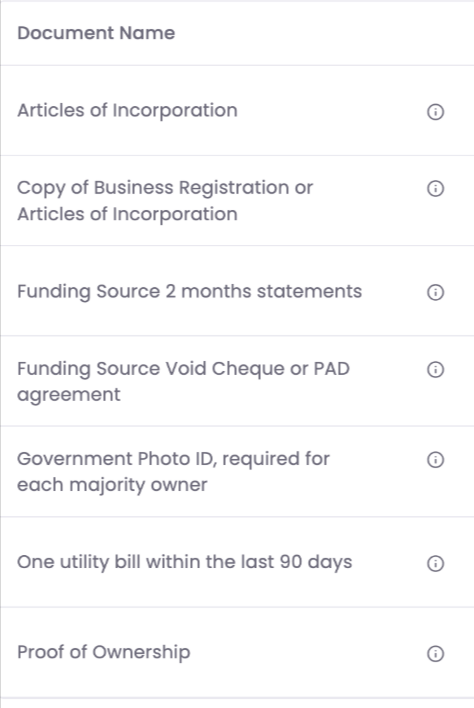

To make the application process as smooth as possible, please have the following documents ready to provide them.

* If you have multiple bank accounts, you will need to provide them with a list of bank accounts that you intend to send money from and each of their associated bank statements.

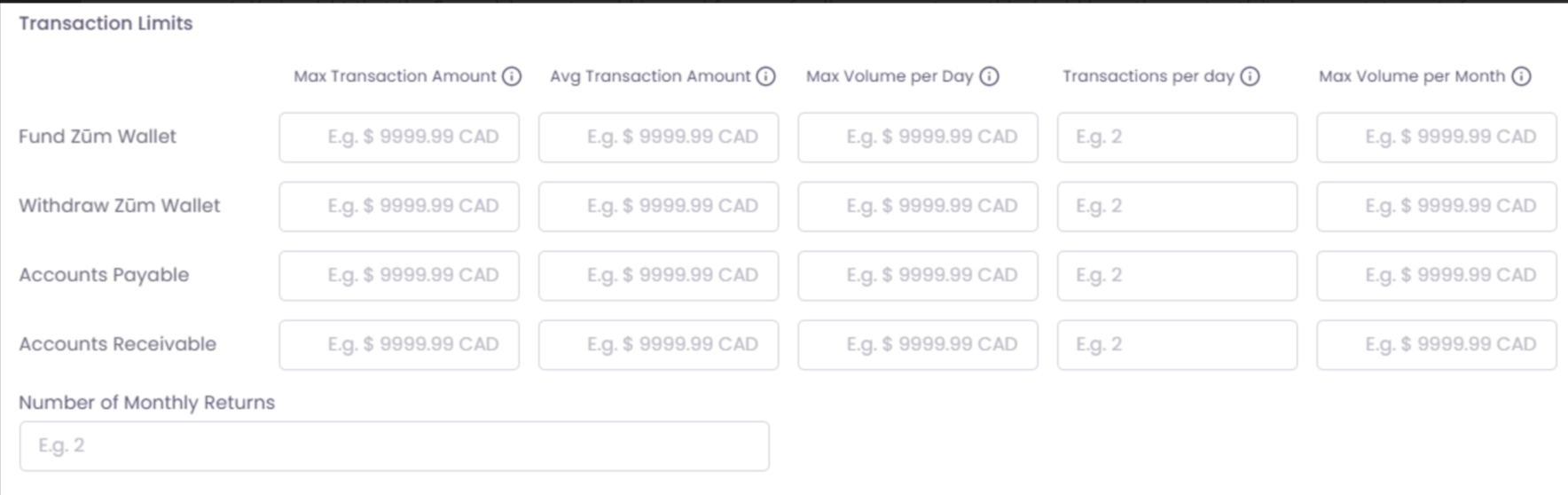

Finally, estimate the limits you might need for each bank account before getting started. For each funding source, you will need to provide estimates on the following numbers:

* It is a good idea to look at a month of activity from your busiest month in Real Estate. If that is June every year, go take a look at those transactions to get your estimates. Remember that these limits can be adjusted, so they aren't set in stone.

Tips to help you estimate these items:

Max transaction amount: This should be the highest commission paid out to a single Agent. e.g. $200,000

Avg transaction amount: This should be the average amount of commissions paid out. This is an estimate, so you can view Loft data or use your best guess and estimate an amount slightly higher. e.g. $10,000

Max volume/day: This would be the maximum volume from payouts you do in an average day. (This should be the number of payouts you do times the average commission amount, and add a little extra to cover you in the busy season.) e.g. $60,000

Transactions/day: The number of payments from this account on an average day. e.g. 5

Max Volume/Month: This is the maximum you will pay out in a month, take the daily maximum and multiply by 20 working days or more if you operate over the weekend. e.g. $1,200,000

To make the application process as smooth as possible, please have the following documents ready to provide them.

* If you have multiple bank accounts, you will need to provide them with a list of bank accounts that you intend to send money from and each of their associated bank statements.

Finally, estimate the limits you might need for each bank account before getting started. For each funding source, you will need to provide estimates on the following numbers:

* It is a good idea to look at a month of activity from your busiest month in Real Estate. If that is June every year, go take a look at those transactions to get your estimates. Remember that these limits can be adjusted, so they aren't set in stone.

Tips to help you estimate these items:

Max transaction amount: This should be the highest commission paid out to a single Agent. e.g. $200,000

Avg transaction amount: This should be the average amount of commissions paid out. This is an estimate, so you can view Loft data or use your best guess and estimate an amount slightly higher. e.g. $10,000

Max volume/day: This would be the maximum volume from payouts you do in an average day. (This should be the number of payouts you do times the average commission amount, and add a little extra to cover you in the busy season.) e.g. $60,000

Transactions/day: The number of payments from this account on an average day. e.g. 5

Max Volume/Month: This is the maximum you will pay out in a month, take the daily maximum and multiply by 20 working days or more if you operate over the weekend. e.g. $1,200,000

Related Articles

Getting Started with ZUM RAILS

Zum Rails offers an excellent alternative for paying and receiving funds. Now available for both our USA and Canadian clients! They provide low transaction rates and a dedicated portal to expand and enhance your options for Agent billing. They offer ...Payment Processing - Troubleshooting & FAQ's

There are a few common issues that may occur when using a payment processor that require troubleshooting. Locked payment status - this may occur if there is a delay between clicking the Payout creation in Loft47, and the time it takes to send / ...Deposits using payment processors

Request a deposit via Payload or Zum Rails. You can use either Zum Rails or Payload to pay your Agents. In this help article, we walk through the process using Payload; however, the workflow will be the same with Zum. Please note that requesting ...Paying out and taking payments - Payment processors

Pay your Agents: You can use either Zum Rails or Payload to pay your Agents. In this help article, we walk through the process using Payload; however, the workflow will be the same with Zum Rails. Payload Turn around times All payment processed after ...HOW TO SET UP BANK ACCOUNT AS AN AGENT

In Article Navigation can be found to the right of this article or via the buttons below Setup Account Select Default Account Unverified Status Turnaround Times Set up Account In Loft47, your Brokerage will can use either Payload or Zum to pay your ...