Is Loft47 right for you?

Should you sign up for Loft47? Check out these resources, which will help you decide. Picking technology is tricky, and we love working with Brokerages that we are a great fit for. This is not a one size fits all business & we’re happy to recommend alternative solutions with no hard feelings, so read on!

Are you thinking of joining other happy Brokerages in the Loft47 community? Did the demo make you hopeful you’ve found the right app? If you’re not already convinced, this information will help you make the best decision for your brokerage. If you have not already checked out our 20 minute on demand overview, please do so! What do other brokerages have to say about their experience? https://loft47.com/client-stories/

Overview of Loft47 workflow options for brokerages:

1) Ditch the duplicate data entry! Dotloop or DocuSign Rooms information or SkySlope information goes to.....

2) Loft mini demo ....(or deals may be entered by Admins or Agents) and then deposits / transfers and deal payouts go to....

3) Ditch the duplicate data entry again! Xero or QuickBooks Online - where you can cut checks or.....

4) Use Loft47 stand alone and make accounting entries manually into another solution (we know there are some business cases that demand another accounting solution, so we’re happy to help).

Check out importing a deal from Dotloop, processing the deal in Loft47 & the automated accounting entries in QuickBooks Online in this 8 minute explainer

- Loft47 now offers direct deposit payments embedded workflow, using either Zum Rails or Payload See how simple it is to pay your agent

- Check out our direct deposit payment options here: https://support.loft47.com/portal/en/kb/loft-technologies/loft-app/integrations/paymentprocessors

W2 / T4 Staff Payroll (solutions that integrate with Xero / QuickBooks Online)

Consider Gusto, or QuickBooks Online payroll add on

Consider Payment Evolution or Wagepoint for Canadian staff payroll.

Loft for Agents

Pricing for Loft47 is based on the number of agents in your brokerage. We don’t charge for logins, for multi-offices, integrations, or any other nonsense.

Accounting Options:

Using QuickBooks Online?

Using Xero?

Watch long form recorded demos here:

https://loft47.com/resources/demo-can/

https://loft47.com/resources/demo-usa/

Reporting overview:

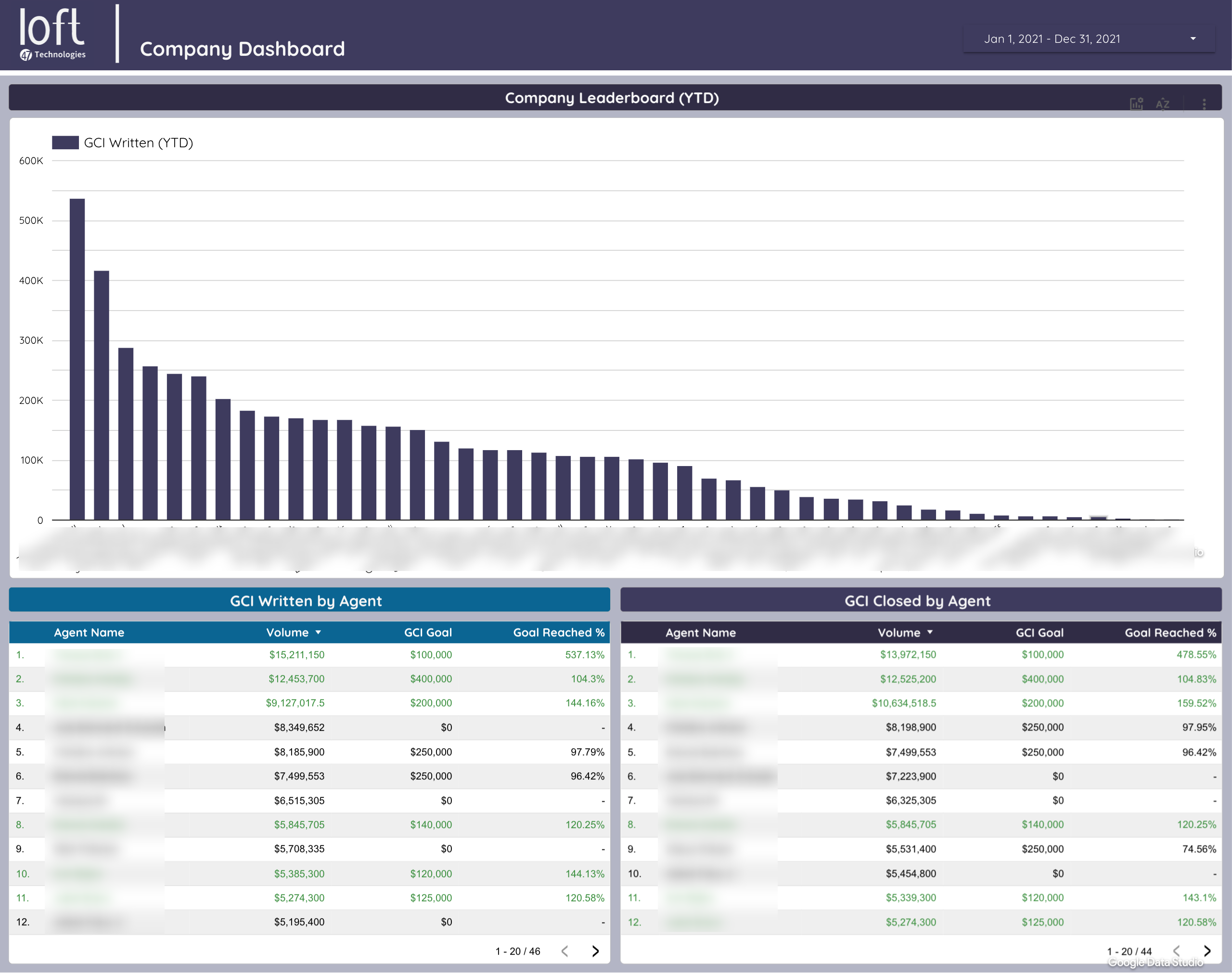

Dashboard KPI Reporting - check it out here - LoftPro

Brokerage dashboard sample

Individual Agent dashboard sample:

* Dashboard customization is available - you may use your own resource to blend data, or use our resource at $75/hour.

General Brokerage Reporting:

* Dashboard customization is available - you may use your own resource to blend data, or use our resource at $75/hour.

All reporting is filter based, so each report or data export can be generated for any date range, can be based on Closed or Pending transactions, based on Agent, Teams, Offices or across the Brokerage as a whole. This list is not exhaustive of the reporting offering.

Deductions - View fees / deductions on paid transactions. Filter by deduction, agents or both for a more targeted review.

Deduction Caps - Agents and fees assigned to their profile, as well as where they are at in terms of levels within the range that the fee is calculated on.

Deposits - All deposits by bank account & date range. The report may assist bank reconciliations.

Franchise - Loft47 provides franchise statistics reporting for some brands.

Production - Agent by deal production information including gross commission, volume, end count, address & dates for each transaction paid out for export.

Income - Deductions with a type of Income inform projected company income, Review info by deduction name, agent or office.

Uncovered expenses - Compares agent outstanding AR balance & net payables to highlight any agents without enough deal pipeline to cover receivables.

Performance - Rank your agents your way, with summary and detail back up information in 1 report on 2 worksheets. This is the go-to-report for kudos, awards and bravos.

Subledger - Used for Trust / Escrow bank accounts, where the brokerage holds funds per deal. Use this report to verify your Trust balance, to be compared to the accounting Liability balance.

Tax Returns - Generate annual 1099 or T4A reporting for your brokerage year end reporting.

Transfers - Review bank transfers between Brokerage accounts for the date or range provided. Use our automated delivery setting to facilitate daily transfer activity.

Implementation - Who does what now?

This is the basic rollout activity, we'll help all the way along until you are live with Loft47! You’ll be pleasantly surprised with how quickly all integrations connect.

High level activity

- Spin up Loft47 (Loft does this)

- Integrate Xero or QuickBooks Online, edit or upload standard GL & map (we'll do this together)

- Integrate Dotloop / SkySlope / DocuSign Rooms if applicable (we’ll do this together)

For any size of brokerage - share your current workflow charts or process spreadsheet & we’ll happily help document the new processes / steps that can now be skipped!

Loft47 rollout

Loft47 initial configuration, invite Broker / Admin & set up fees (Loft does this)

Training 1 - Add new agents, start importing deals (joint effort - client to also run through Loft7 online training - Unit 1, 2 & 3). In addition to our online course, one-on-one training is also included with each new Brokerage set-up.

Training 2 - Review deals & any further configuration & deduction tweaking (joint effort)

Training 3 - Go live (joint effort - with trainer assistance closing & paying out deals)

Training 4 - Data & Reporting review (joint effort)

Agent introduction webinar

Loft47 is a complete replacement for legacy systems, when you are using Loft47 + Xero or QuickBooks Online. We assist with the set up and integration points, so that when you close and payout real estate deals, all accounting entries are automated. That means you have complete financial statements with no manual journal entries. Bank & CC recs take 1/4 of the time as compared to products that do not offer bank & credit card feeds.

Key Benefits of Loft47 over legacy type systems

Loft47 is cloud based & mobile, use Loft to enter, review, approve and payout deals anytime from anywhere.

Online chat support where the average response time is less than 2 minutes, backed up by phone and email support. (Support hours are M-F, 9 - 9 EST) We have better support than…anyone as far as I can tell.

Multiple integrations to transaction management solutions to make entering deals simple & fast.

Our pricing does not increase with the number of admins / users, and also does not increase with the number of offices, or logins. We don’t roll that way.

The Loft47 monthly fee includes logins for every member of the brokerage, including agents. Agents see only their own deals / production / payroll history etc, including self-serve 1099s.

Technical information related to data storage / server location (Canadian brokerage compliance)

Extra information for brokerage using Broker Wolf / Back Office.

We do the heavy lifting when it comes to migrating set up data from Lone Wolf to Loft47. That includes us helping you export set up data from Lone Wolf (I.1.1 / I.1.P.8 / E.3 / E.1.3 and a few more, depending on your business use of LW). Once we have that data, we reconfigure the files and complete the set up of Loft47. After your live date we'll ask for 8.7.1 & 5.P.9 to gather your YTD information so the 1099 / T4A reports are complete for the full year.

Related Articles

Loft47 -training resources for new users and cross training

New to using Loft47? This resource guide will help you get up-to-speed. This comprehensive spreadsheet provides links to all of our general training resources. Please open the spreadsheet, copy the whole spreadsheet and paste into your OWN ...How Loft works with Dotloop

In Article Navigation can be found to the right of this article or via the buttons below Enable Integration Connect Dotloop Load Loops Create a Deal Requirements to create a deal Sync a Deal Contact Sync Field Mapping The dotloop integration will ...Acquiring a Brokerage that already uses Loft?

Here is a list of all the things to consider when merging a brokerage into another. All of this (except 1 item can be done by the user) However, we can assist you with this migration. The cost for Loft to assist is $75/hour Brokerage to Brokerage ...Xero/Loft - Common FAQ's

In Article Navigation can be found to the right of this article or via the buttons below Xero Support Xero User Roles Xero Bank Feed Setup Bank Feed Support Bank Account Importing How Data is Shared Loft to Xero GL Posting Xero Income Statement ...Agent Orientation

Welcome to Loft Vid Sign into Loft You can sign into our app via www.loft47.com and then clicking the Sign in button Or Bookmark our sign in page https://app.loft47.com/users/sign_in Single Sign On Google Sign in, if your email is a gmail, you can ...